This is according to PitchBook’s Mobility Tech Q1 2020 report which says that much of this uptick was driven by three key deals. These included: Go-Jek’s $3 billion Series F round in March, Waymo’s $2.3 billion VC round in March, and Grab’s $886 million later-stage VC round in February.

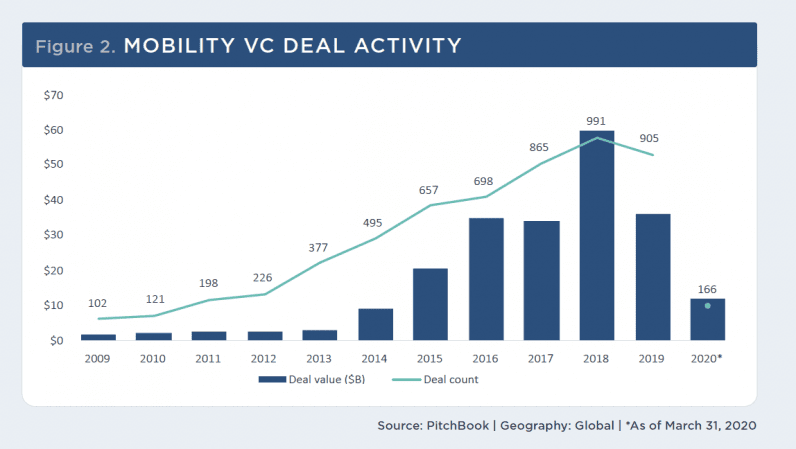

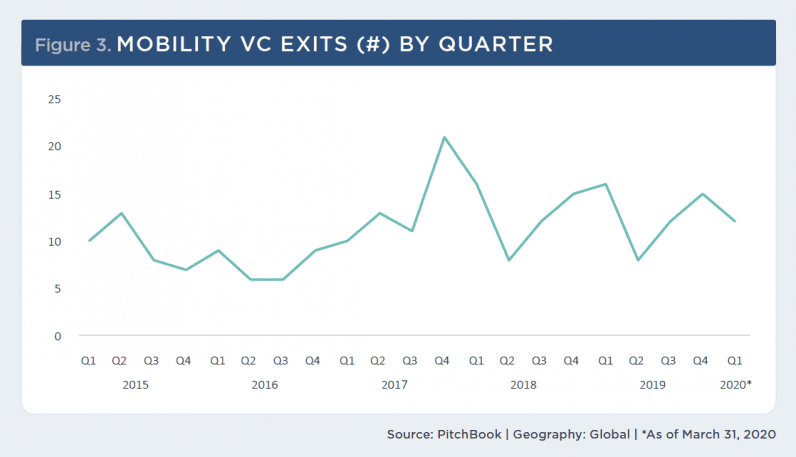

If these three deals were excluded, the data shows that VC investing during Q1 reached $5.6 billion, down 23% YoY. [Read: How to write an email pitch VCs will actually read] At the same time, VC exit activity remained relatively healthy with 12 VC exits in the quarter, down from 16 in Q1 2019 and 15 in Q4 2019. The report notes that venture capital financing in the space peaked in 2018, when approximately $60 billion were deployed into mobility startups. In 2019, investors spent $36 billion. Overall, the investment has been driven by self-driving technology, the popularization of shared mobility, and the development of electronic or connected vehicle technologies. All of this, the report adds, has resulted in a resurgence in innovation in the transportation sector over the past decade.

As is the case with most sectors, the report argues that dealmaking in Q2 2020 will also be affected by the coronavirus pandemic. “Startups are likely to face a more challenging funding environment, with deal terms increasingly favoring investors,” it notes — and that’s on top of startups losing leverage in the M&A sphere. “We expect to see significant valuation haircuts in the space and declining deal activity in the near term. We anticipate exit activity to be muted in Q2 due to a drop in strategic acquisitions from corporates and generally volatile public market conditions,” the report continues.

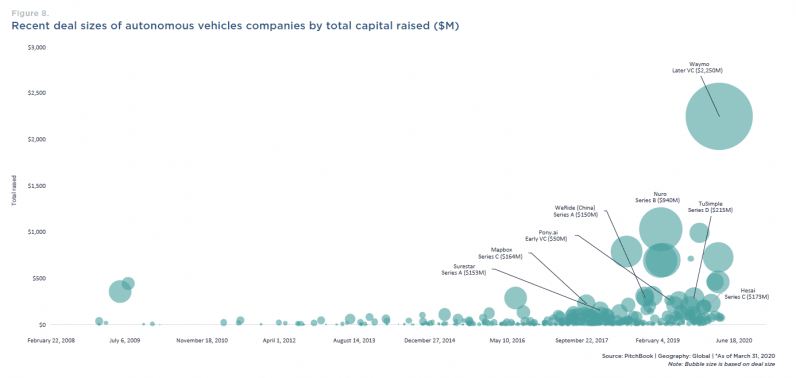

Autonomous vehicles: A record figure in Q1

Venture capital investors poured a record $3.4 billion in Q1 2020 — much well above the $793.7 million invested during the same time period in 2019. This was largely driven by Waymo’s aforementioned raise, which pushed the company to a $30 billion valuation. According to the report, corporate investment from car manufacturers drove much of the deal activity seen in the sector. In July last year, Cruise Automation — a subsidiary of GM — raised $3.4 billion of development capital from SoftBank and General Motors.

Ford has pledged $4 billion to autonomous vehicle development, and Volkswagen has committed $2.6 billion in capital into Fordowned Argo AI. In 2018, Intel acquired Mobileye for $14.9 billion, marking the largest corporate acquisition in the space to date. The report says that, historically a significant portion of VC investment in the space has gone toward startups focusing on developing full-stack autonomous solutions, such as Zoox, Nuro, and Aurora. However, there are some good news for more specialized startups. PitchBook detects signs this is starting to change as investment expands into companies that focus on a single aspect of autonomy, such as perception or localization, or otherwise augment the autonomous vehicle space.

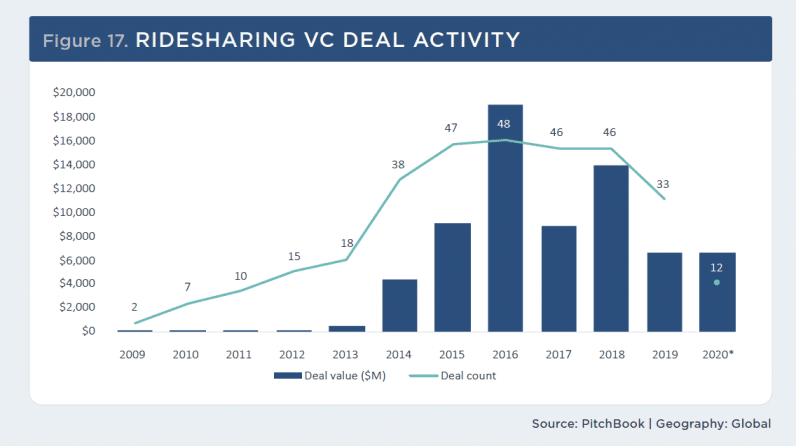

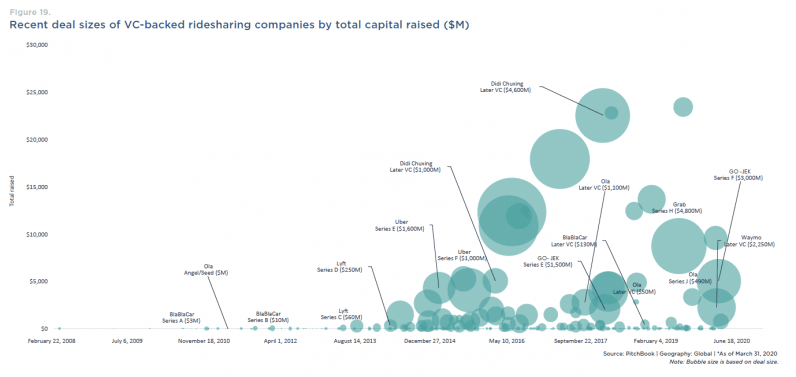

Ridesharing: Investors spent a hefty $6.6 billion

Investors spent $6.6 billion on ridesharing companies during Q1 2020 — representing a drop of 38% YoY but an increase from the $1.4 billion raised in Q4 2019. Top deals included Go-Jek’s $3.0 billion Series F round, Grab’s $886 million later-stage VC round, and Via’s $400 million Series E round.

Overall, the report states these large rounds illustrate investor’s appetite for ridesharing businesses stayed strong despite the near-term uncertainty generated by the coronavirus pandemic. “Longer term, we expect continued VC investment to focus largely on international late-stage ridesharing competitors such as Grab, Didi Chuxing, and Ola,” it adds.

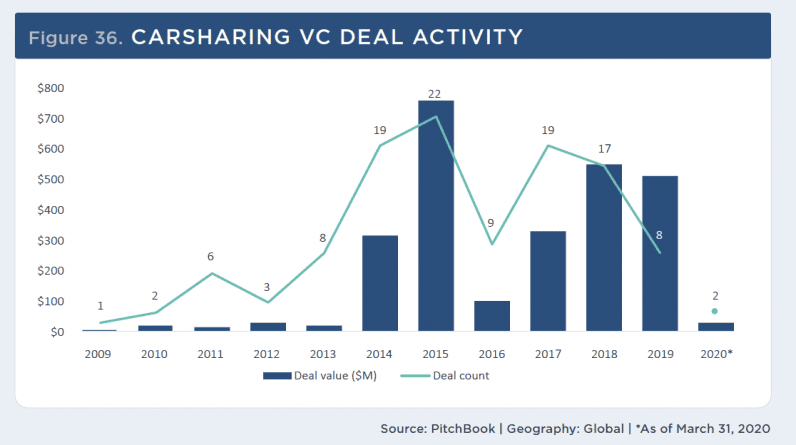

Carsharing: Will suffer as a result of coronavirus

On another note, carsharing deal value dropped in Q1 2020 by 40.9% YOY. The standout deal during the quarter was Turo’s $30 million later stage VC round from ADIT Ventures, Larry Fitzgerald, and Tauheed Epps.

“Investment in this segment has cooled relative to previous years, due to existing headwinds such strong competition from ridesharing services and difficult unit economics associated with fleet ownership,” says the report. “As a result, American brands ReachNow, Car2go, LimePod and Maven have shut down or scaled back operations in recent months, while OEMs such as BMW and Daimler have restructured their European MaaS offerings,” it adds. As expected, the report says the carsharing industry will likely face a more difficult funding environment as social distancing rules reduce the near-term attractiveness of the space.

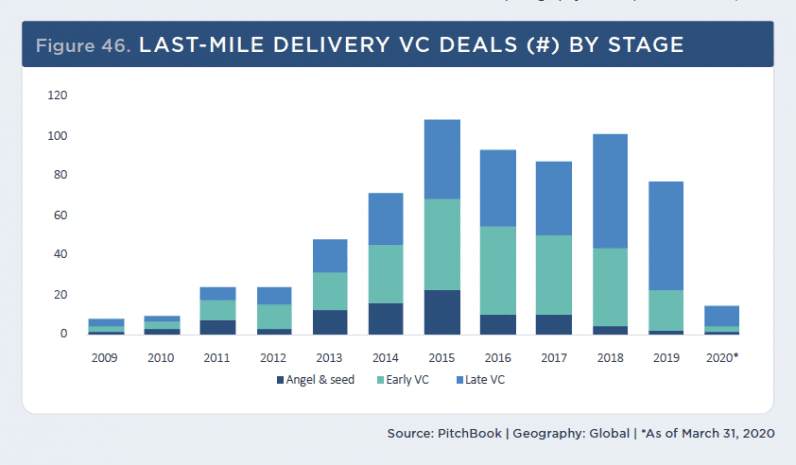

Last mile delivery: Increased spending

Q1 2020 was a strong quarter for VC investing in last-mile delivery with investors spending $5.3 billion, a sum representing increases of 62.35% YoY and 128% over Q4 2019. Top deals included include Go-Jek’s $3.0 billion Series F round and Grab’s $886 million fundraise.

The report says deal value in the space has seen an upward trend over the past few years as delivery services rapidly expand in an underpenetrated market. “Capital deployment in delivery continues to be dominated by late-stage deals, reflecting the relative maturity of VC backed companies operating in the space. We expect the funding environment for delivery startups to be favorable relative to other mobility segments in the near to medium term,” it concludes. It seems ridesharing companies were the biggest winners during Q1 but with the coronavirus pandemic threatening current activity it’ll be interesting to see whether VCs end up spending their money on early-stage companies, if at all.